Our client is a fast-growing finance firm based in Mexico that funds small to mid-size real estate development projects. Their challenge wasn’t finding clients—it was handling the flood of loan requests and internal coordination that came with scale.

Their loan officers were overloaded. Follow-ups were slipping. Each deal involved 10+ forms and emails across different people, and the team was stuck juggling everything in spreadsheets, WhatsApp, and email threads.

They came to us because they knew this mess wasn’t sustainable—and it was already costing them deals.

The agency had a strong client base, but their backend systems couldn’t keep up. Here’s where they were struggling:

Every loan required collecting documents, running internal reviews, managing approvals, and tracking disbursements. The team was handling all of this manually, leading to:

Missed follow-ups on loan documents

Delays in internal approvals

Risk of compliance errors due to inconsistent record keeping

Loan officers, finance, legal, and risk teams were all operating in isolation. There was no shared workspace where everyone could see the status of a deal. As a result:

Team members were asking for the same info again and again

Managers had no visibility into bottlenecks

There was no way to track deal progress across departments

With no system to assign ownership or set reminders, tasks were either forgotten or repeated. Deals stalled for days—sometimes weeks—waiting for one step to be done.

“We weren’t losing clients because of bad service. We were losing them because we didn’t have the structure to handle growth.”

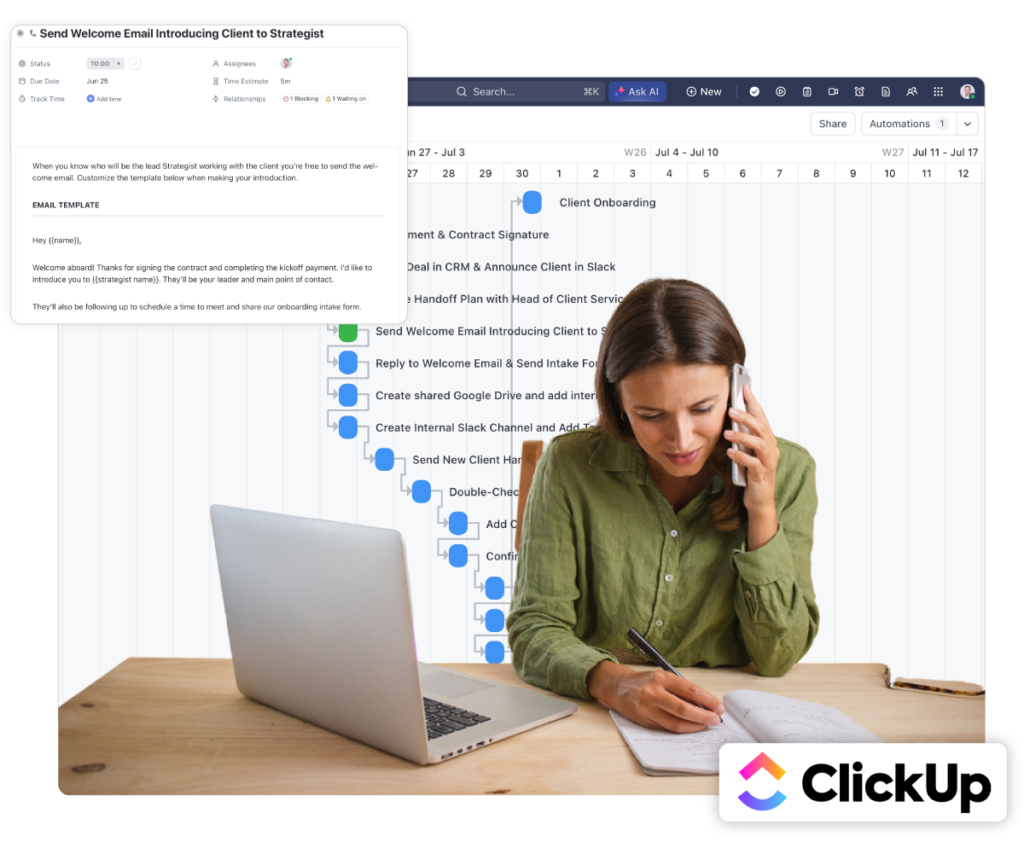

We designed a customized ClickUp workspace to mirror the way their business actually works—built for finance teams, not generic task lists.

We broke down the full lifecycle of a loan—from initial contact, to approval, to disbursement, and final project closure. Each stage became a workflow with assigned owners, clear steps, and built-in automations.

Instead of asking them to change tools, we integrated ClickUp with what they already used—like Google Drive, Gmail, and Airtable. Now, documents and emails auto-link to the right deals, and there’s no need to hunt things down.

We didn’t just build the system—we walked every department through it, created training videos, and gave them a living SOP inside ClickUp. They don’t rely on us to maintain it.

Calls are now logged and linked to contact records. Every call is stored and tied to the appropriate lead or deal. This gives the team full visibility and history for every conversation.

Since the implementation, the business has seen measurable improvements:

40% faster loan turnaround — Applications now move through review and approval without manual chasing.

25% drop in operating costs — Less admin work, fewer errors, no duplicated efforts.

30% boost in loan capacity — The team can now handle more loans without hiring more staff.

Fewer delays, fewer client complaints — Faster decisions and better communication at every stage.

If your finance team is drowning in follow-ups, document chaos, or deal delays—we can build a workflow that actually fits how you work. No guesswork. No unnecessary tools. Just real structure that saves time and gets results.

Book a consultation today.

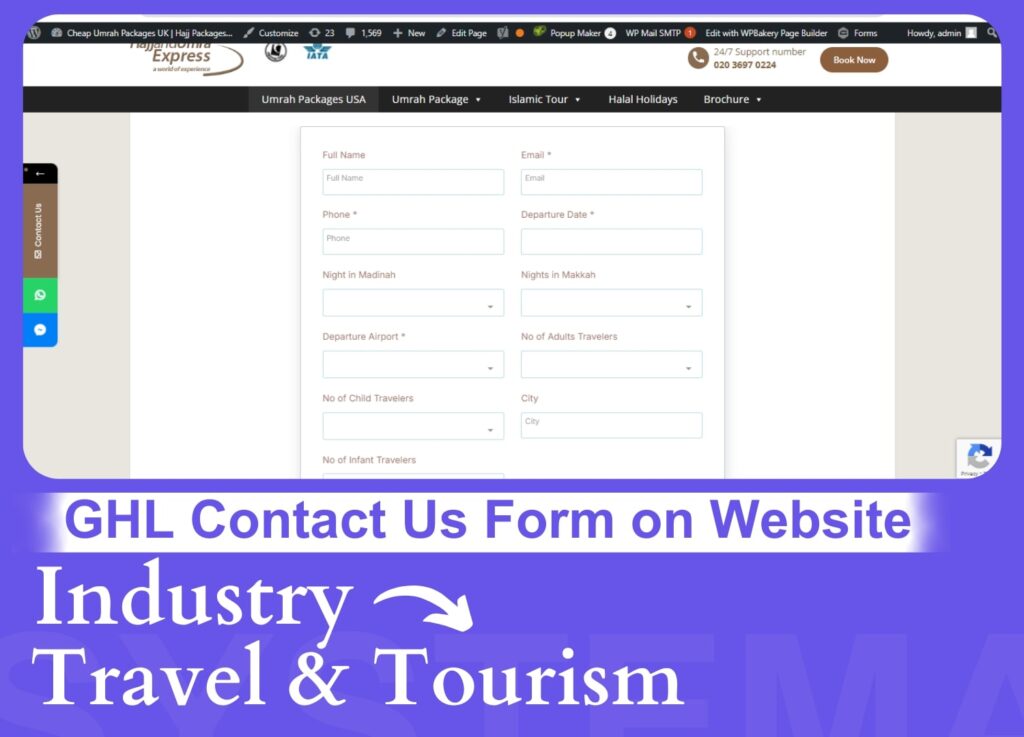

Our Client’s business specializes in international travel experiences. As demand for his services grew, he realized his current system couldn’t keep up

Initially, he managed his operations with Google Sheets and email tools. While they were functional, they just weren’t that effective. These are some common bottlenecks:

he shared..

That’s when we introduced him to Go High Level and implemented a comprehensive solution tailored to his needs.

We needed a system that could handle lead management, automate follow-ups, and track performance all in one place,

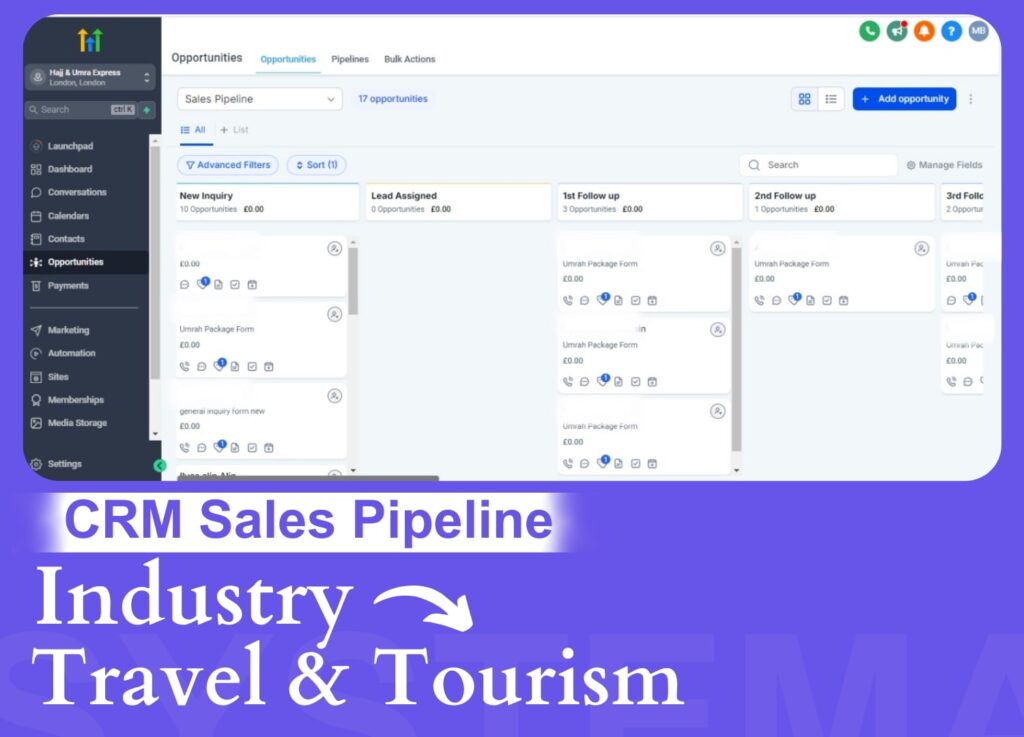

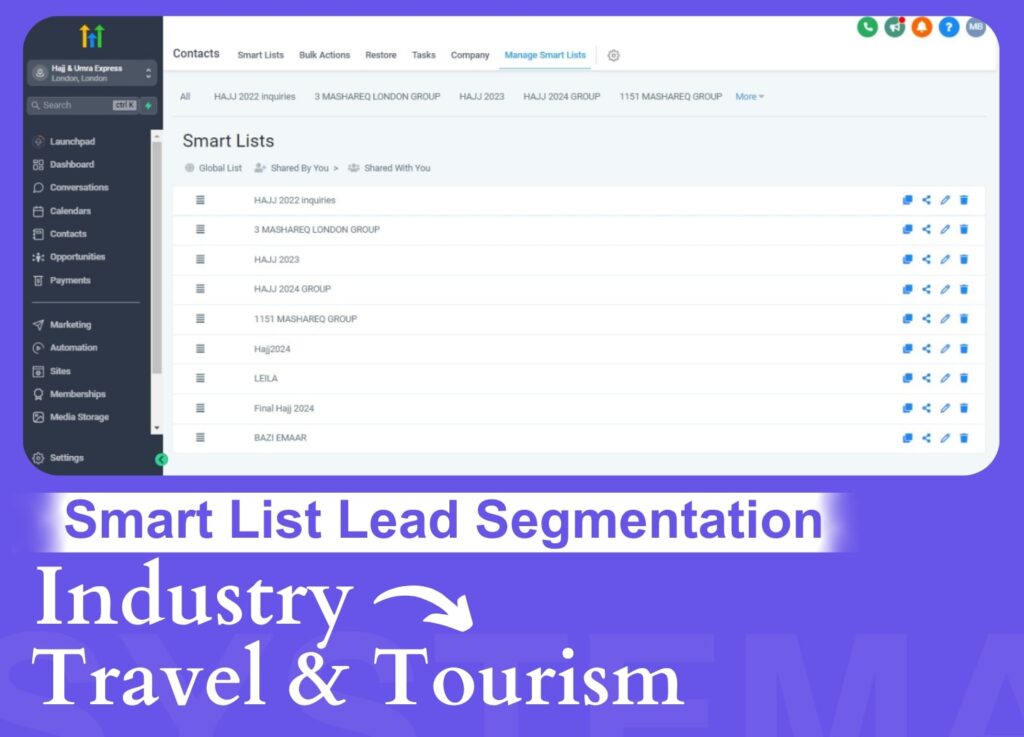

Then, we automated the repetitive tasks. Follow-ups, appointment confirmations, and reminders were triggered at our client’s desired time. For example, if a lead didn’t book within two days, they received a friendly reminder automatically.

Our team built custom dashboards that tracked key metrics (like lead sources, conversion rates, and campaign performance) in real-time. These dashboards provided insights for making data-driven decisions.

We integrated a call tracking system that logs every client interaction. The calls were automatically aligned with the corresponding lead in the CRM. This helped the agency’s team to keep accurate records. Doing so also ensured no communication was missed and provided a detailed history for reference.

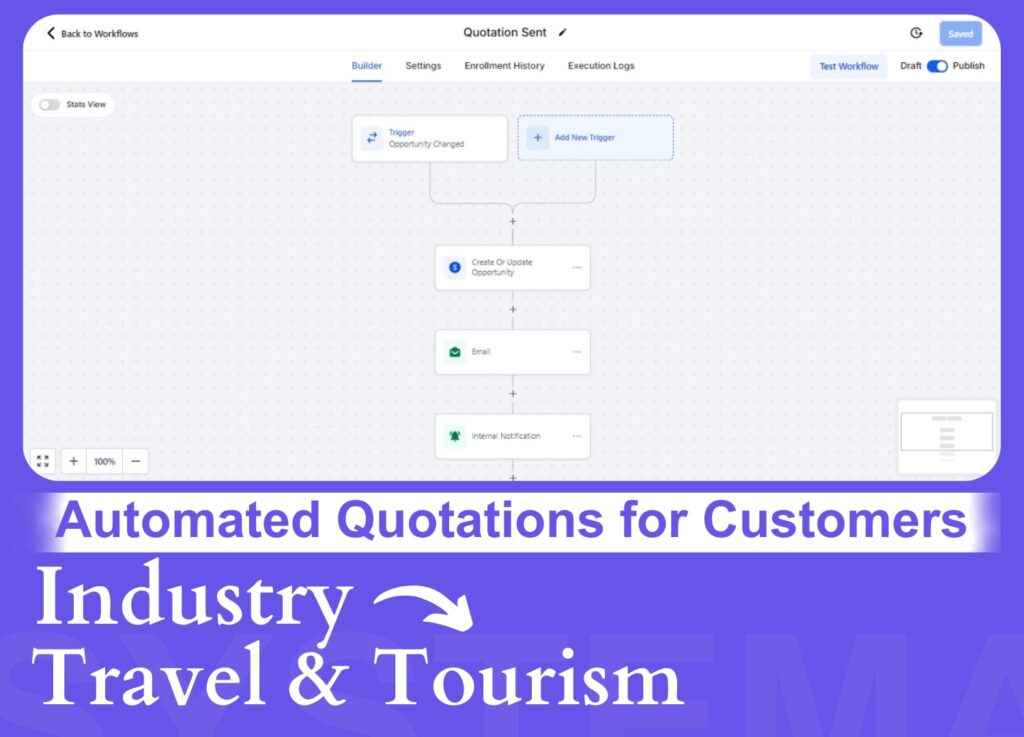

We deployed automated email/SMS campaigns to nurture potential clients. We also designed personalized email and SMS campaigns to reconnect with lost clients, creating more business opportunities.

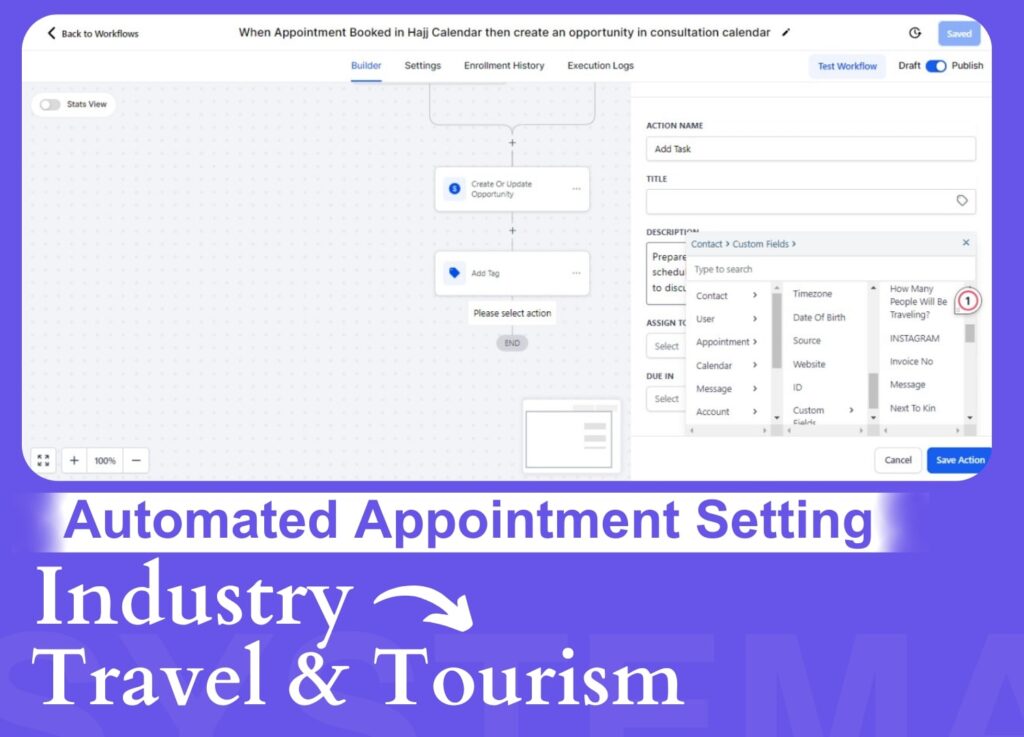

A calendar booking system was integrated into GHL that made scheduling appointments easier for clients. We synced it with automated workflows that sent confirmation emails and reminders to reduce no-shows.

We implemented workflows for post-service review collection. Automated emails and SMS messages are sent to clients after their service, encouraging them to post a review on social media platforms. This helped the travel agency gather over 100 reviews in just three months which drastically enhanced his agency’s reputation.

We added a live chatbot to the website for real-time inquiries and synced it to the CRM. This ensured no lead was overlooked.

First, we customized Go High Level CRM and integrated it with all their sources including forms, live chat, and social media ads. We implemented custom pipelines and lead scoring to make sure high-value leads received immediate attention.

We deployed automated email/SMS campaigns to nurture potential clients. We also designed personalized email and SMS campaigns to reconnect with lost clients, creating more business opportunities.

We integrated a call tracking system that logs every client interaction. The calls were automatically aligned with the corresponding lead in the CRM. This helped the agency’s team to keep accurate records. Doing so also ensured no communication was missed and provided a detailed history for reference.

Then, we automated the repetitive tasks. Follow-ups, appointment confirmations, and reminders were triggered at our client’s desired time. For example, if a lead didn’t book within two days, they received a friendly reminder automatically.

A calendar booking system was integrated into GHL that made scheduling appointments easier for clients. We synced it with automated workflows that sent confirmation emails and reminders to reduce no-shows.

We implemented workflows for post-service review collection. Automated emails and SMS messages are sent to clients after their service, encouraging them to post a review on social media platforms. This helped the travel agency gather over 100 reviews in just three months which drastically enhanced his agency’s reputation.

We added a live chatbot to the website for real-time inquiries and synced it to the CRM. This ensured no lead was overlooked.

Then, we automated the repetitive tasks. Follow-ups, appointment confirmations, and reminders were triggered at our client’s desired time. For example, if a lead didn’t book within two days, they received a friendly reminder automatically.

40% faster response times.

60% reduction in manual tasks.

Real-time dashboards improved decision-making.

25% increase through automated nurturing.

Re-engagement campaigns recovered 15% of lost clients.

Over 100 reviews gathered in three months.